Employee Paycheck Stub: How to Read and Catch Mistakes Fast?

Many employees glance at their employee paycheck stub without knowing what it really says or worse, missing costly mistakes. If you’ve ever felt unsure about your taxes, hours, or take-home pay, you’re not alone. This MOR Software’s guide will walk you through every part of your pay stub so you can catch errors fast and understand exactly where your money goes.

What Is an Employee Paycheck Stub?

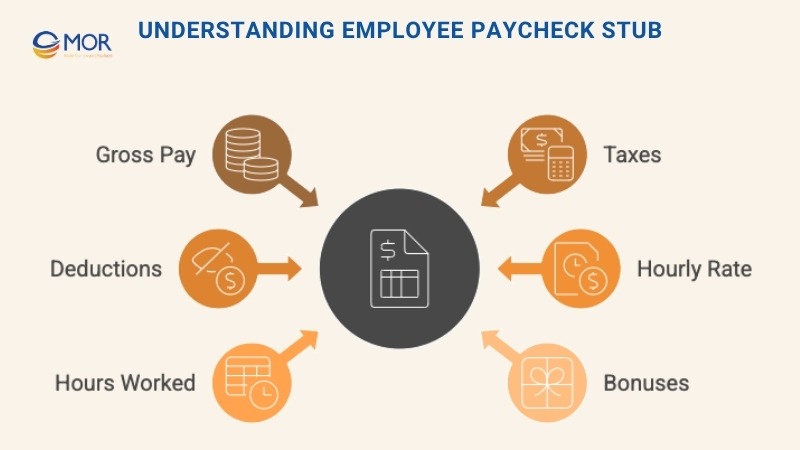

An employee paycheck stub breaks down how your pay is calculated each cycle. It shows how much you earned, how much was taken out, and why. Most stubs are split into three parts: gross pay, taxes, and deductions.

Right up top, you’ll see your earnings for the pay period. This could be weekly, biweekly, semi-monthly, or monthly, depending on your company’s pay schedule.

With 95.15% of U.S. workers now paid by direct deposit, electronic pay stubs have become the default proof of income for most employees.

What’s shown depends on how you're paid. Hourly employees will see total hours worked, rate per hour, and any overtime. Salaried folks typically see a flat pay amount for the period, and maybe a line for bonuses if they got one. Either way, this section is the easiest part of a paycheck statement to scan at a glance.

What Is an Employee Paycheck Stub?

Why Is an Employee Paycheck Stub Important?

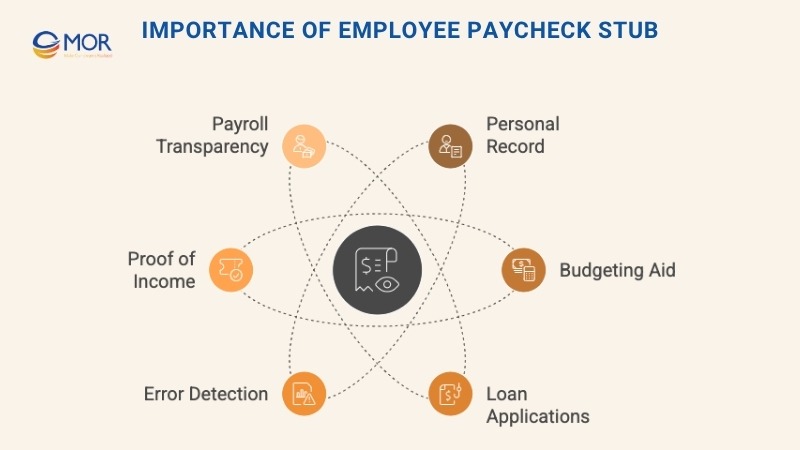

Your employee paycheck stub isn’t just a formality. It’s your personal record of how you’re paid and why. It confirms what you earned, what got deducted, and how much landed in your bank account.

A 2024 global survey found that 53% of employees have dealt with a payroll issue during their career, and 40% were hit in the last year, so frequent stub checks matter. Almost half of workers, 49.14%, say a one-week pay delay would make it very difficult to cover bills.

This isn’t just helpful for budgeting. You’ll need those numbers when applying for a loan, signing a lease, or buying a car. Mortgage lenders routinely list recent pay stubs among the top proof-of-income documents they demand. Most landlords and lenders ask to see recent pay stubs to confirm you’ve got a steady income.

Government offices and aid programs do the same. If you’re applying for student aid or other support, expect to hand over your pay stub as income proof.

And don’t overlook this: catching errors. Regularly checking your employee paycheck stub keeps your employer accountable. If something’s off: wrong tax amount, shorted hours, mystery deductions, you’ll have clear proof to start the fix.

Some companies still hand out printed stubs, but many now share them online. If you’ve worked retail, say with dollar general employee paycheck stubs, you’ve probably seen both.

Why Is an Employee Paycheck Stub Important?

How to Read an Employee Paycheck Stub

Decoding an employee paycheck stub gets easier once you know what to look for. It’s split into sections showing your pay, taxes, and deductions. Let’s walk through what each part means.

How to Read an Employee Paycheck Stub

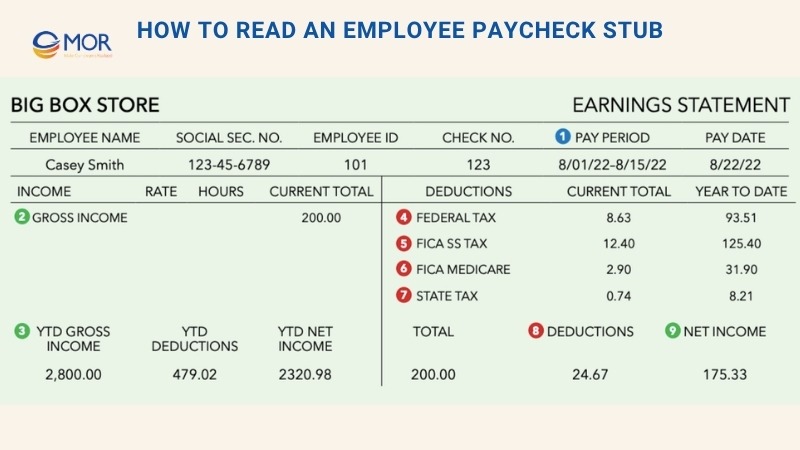

1. Pay Period

This is the range of calendar days covered by your payment. Your company sets this schedule, weekly, biweekly, or otherwise.

2. Gross Income

This is your total pay before any taxes or deductions. Whether you're salaried or hourly, it’s the full amount you earned during the pay period.

3. YTD (Year-to-Date)

Short for year-to-date, this section shows the total you’ve earned, the total withheld, and your take-home pay so far this year. It’s a quick way to spot trends or catch up on your total stub payments.

4. Net Income

Also called your take-home pay, this is what actually hits your account after taxes and other deductions. It’s the bottom-line number most people care about.

5. Federal Tax

This line shows how much was withheld for federal income tax. Withholding each pay period helps you avoid one large payment during tax season.

6. FICA – Social Security Tax

A portion of your pay goes to Social Security under FICA rules. This supports retirement and disability benefits for millions of Americans.

7. FICA – Medicare

Another FICA deduction, this one funds Medicare. It helps provide health insurance for older adults and certain people with disabilities.

8. State Tax

If your state charges income tax, it’ll show here. The withheld amount reduces what you owe when you file taxes later.

9. Deductions

This catch-all section covers insurance premiums, benefits, or other voluntary programs. These get pulled from your gross income before you see your employee paycheck stub total.

How to Calculate Employee Paycheck Stub

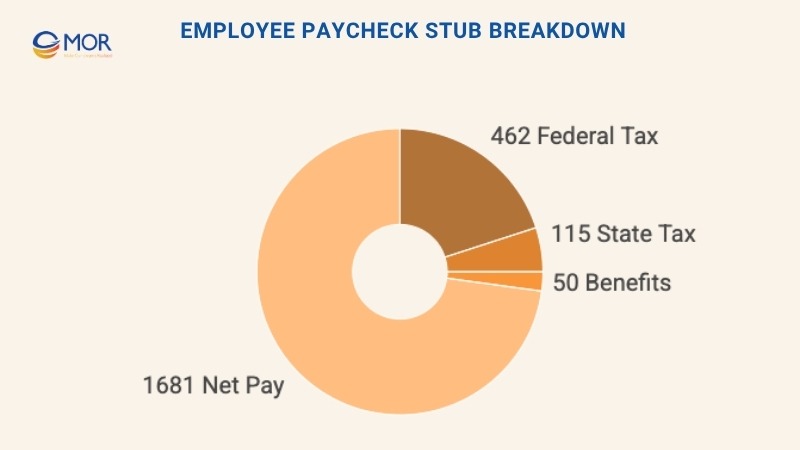

Let’s say an employee earns $60,000 a year and gets paid every two weeks. That breaks down to $2,308 in gross pay per pay period.

Now take out taxes and other deductions. If federal tax withholding is 20%, that’s $462. State tax is 5%, or $115. Add a $50 deduction for health insurance. That brings total deductions to $627.

So, subtracting $627 from the $2,308 gross amount leaves a net pay of $1,681. That’s the amount shown on the employee paycheck stub as take-home pay.

The stub should clearly show gross pay, each deduction, and net pay. It also needs to include year-to-date totals. For hourly roles, be sure hours worked, rates, and any overtime are included. If you’re using an employee paycheck stub template, these fields should be built in to avoid missing anything.

How to Calculate Employee Paycheck Stub

State Requirements for Employee Paycheck Stub

There’s no single federal law that forces employers to issue pay stubs. The Fair Labor Standards Act does require businesses to keep accurate time and pay records, but how you share that info? That’s up to your state.

A 2025 breakdown from Fingercheck shows that 26 states now require employers to provide a stub, paper or electronic, for every pay period.

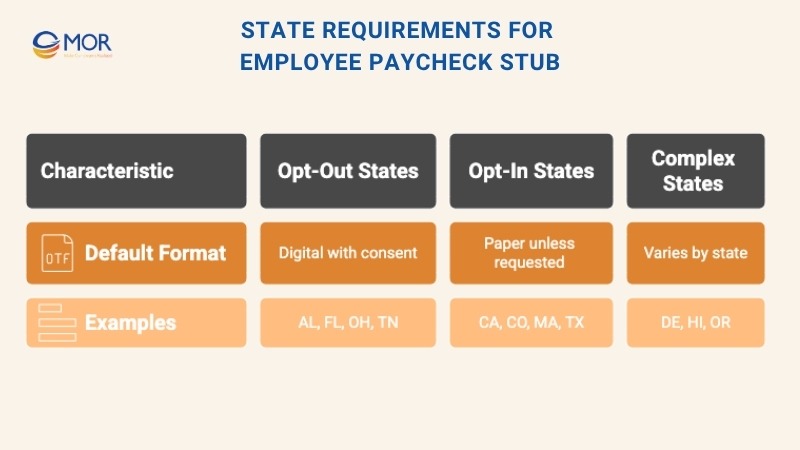

Each state sets its own rules for providing an employee paycheck stub, and they generally fall into one of three categories: opt-out, opt-in, or complex.

State Requirements for Employee Paycheck Stub

Opt-Out States

In these states, employers can switch how they deliver pay stubs, paper or electronic, but only with employee consent. If a worker says no, the original method stays. Common opt-out states include:

Alabama, Arkansas, Florida, Georgia, Louisiana, Mississippi, Ohio, South Dakota, Tennessee

Opt-In States

Here, employers must provide a paper pay stub unless the employee requests digital delivery. Once they switch to online, the paper copy isn’t required anymore. Examples include:

California, Colorado, Connecticut, Iowa, Maine, Massachusetts, New Mexico, North Carolina, Texas, Vermont, Washington

Complex States

Some states don’t follow either model. They have their own detailed rules. If you operate in any of these, read the fine print:

Delaware, Hawaii, Minnesota, Oregon

Beyond those categories, there are a few other variations:

- No requirements: Some states don’t require any form of pay stub.

- Access states: You must provide a pay stub, digital or paper.

- Access/print states: You can use any format, but employees must be able to easily print or access their payroll pay stubs online.

If your team spans multiple states, you’ll need a system that handles all these variations without missing a beat.

Common Mistakes When Creating Employee Paycheck Stub

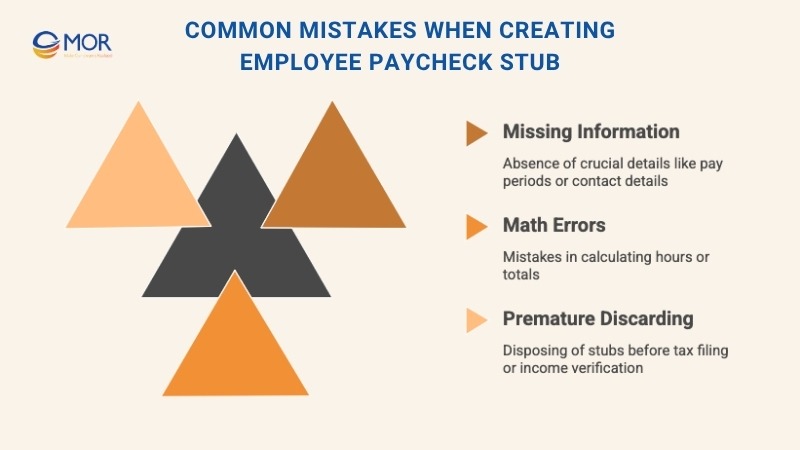

Ernst & Young found that one in five U.S. payrolls contains errors, each costing about $291 to fix, and the typical company makes roughly 15 corrections every single pay period. Even small errors on an employee paycheck stub can cause real problems down the line. Here are the usual suspects to watch for:

Common Mistakes When Creating Employee Paycheck Stub

Supplying Incomplete or Incorrect Info

Missing pay periods, skipped payment dates, or leaving out contact details, these might seem minor but can throw off tax reporting and audits. Always double-check the basics before sending out a stub.

Errors in the Math

One wrong number can mess up totals for hours, overtime, or YTD balances. A common slip? Marking 40 hours worked for two weeks when it should be 80.

Manual entry invites mistakes, so it’s safer to use a tool or platform that calculates things for you. A system that generates weekly pay stub details automatically keeps things consistent and accurate.

Tossing It Too Soon

Some employees throw away their pay stubs without checking them. That’s risky. You should keep every employee paycheck stub until you’ve filed your taxes. You might also need them when applying for a mortgage, loan, or new apartment. They’re proof of income, and proof your employer paid what they promised.

Practical Tips for Managing Employee Pay Stubs Effectively

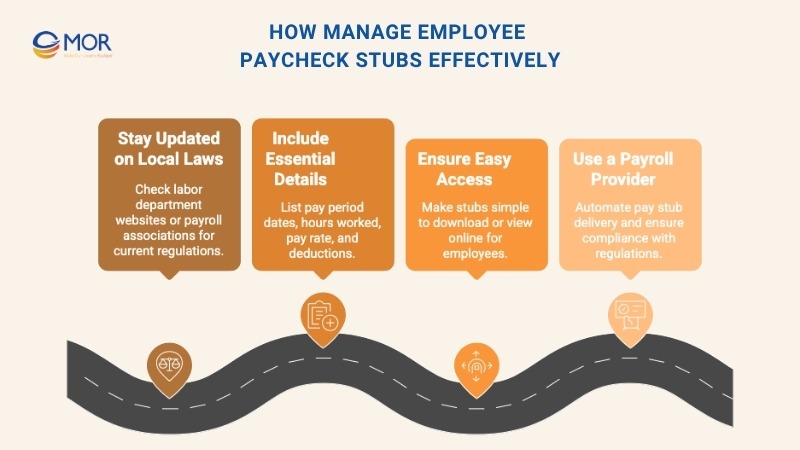

A messy employee paycheck stub can confuse your team, or worse, lead to legal trouble. These habits help keep things clean and compliant. The stakes are high because the IRS assessed $84.1 billion in civil payroll penalties in fiscal year 2024.

Practical Tips for Managing Employee Pay Stubs Effectively

Stay on Top of Local Rules

Every state handles pay stub laws a little differently. Some cities even have their own add-ons. Use trusted sources like your state labor site or a payroll industry group to stay current.

Always Include the Right Details

The basics matter: pay period dates, hours worked, rate of pay, gross and net amounts, and deductions. If your industry has extra rules, like union dues or shift differentials, those need to be listed too.

Payroll problems already touch an estimated 82 million American workers, so clear information is more than a nicety.

Make Them Easy to Get

Pay stubs should be accessible without a hassle. Whether your team needs them for a paystub download, loan application, or just personal tracking, keep them simple to access and save. More than 90% of employees say they receive their paycheck on time, setting an expectation your process should match.

Consider a Payroll Partner

If managing all this sounds like too much, a payroll provider can help. Most offer automatic pay stub delivery and stay current with local regulations, so you don’t have to stress over compliance.

MOR Software Can Helps Businesses Automate Pay Stub Management

Managing employee paycheck stub sounds simple until it’s not. Between compliance across states, tax changes, and deduction tracking, it’s easy for businesses to slip up.

That’s where MOR Software steps in.

MOR builds custom payroll and HRM software that handles the heavy lifting. From automated pay stub generation to real-time tax deduction calculations, we make sure every paycheck tells the right story. For companies operating across multiple states, our systems support opt-in, opt-out, and complex compliance rules, right out of the box.

We also integrate seamlessly with existing platforms, so you don’t need to rip out what works. Whether it’s syncing with time-clock systems or applying FICA calculations on the fly, MOR’s development team ensures your pay stub process stays accurate, legal, and employee-friendly.

If you're tired of patchwork spreadsheets and manual errors, it’s time to modernize. Talk to MOR about building a payroll system that scales with your team.

Conclusion

Understanding your employee paycheck stub isn’t just about checking your salary, it’s about protecting your income, staying compliant, and avoiding tax-time surprises. Whether you’re reviewing hours, deductions, or year-to-date totals, one quick scan can save a lot of hassle later.

If you’re managing pay for a team, accuracy isn’t optional. That’s why MOR Software builds payroll systems that automate compliance, simplify reporting, and scale with your business. Need a smarter way to manage pay stubs? Contact us today!

Rate this article

0

over 5.0 based on 0 reviews

Your rating on this news:

Name

*Email

*Write your comment

*Send your comment

1