Differences Between Payslip vs PayStub For Businesses To Choose

Many businesses still confuse a pay stub vs payslip, even though choosing the right one can affect everything from payroll compliance to employee trust. If you’ve ever mixed up payslip vs paystub or wondered what the actual difference is, you're not alone. This MOR Software’s guide will break it down clearly so you can make the right call for your team without second-guessing your payroll process.

Understanding Pay Stub Vs Payslip

The shift to electronic delivery is well underway; PayrollOrg’s 2024 Getting Paid in America survey found that nearly 92% of American workers receive their wages by direct deposit. A Paycor analysis places adoption even higher at 93%, showing how standard digital pay statements have become .

Before choosing between the two, it helps to understand what each one actually includes. Let’s break down what a pay stub vs payslip really means and how they’re used in different regions.

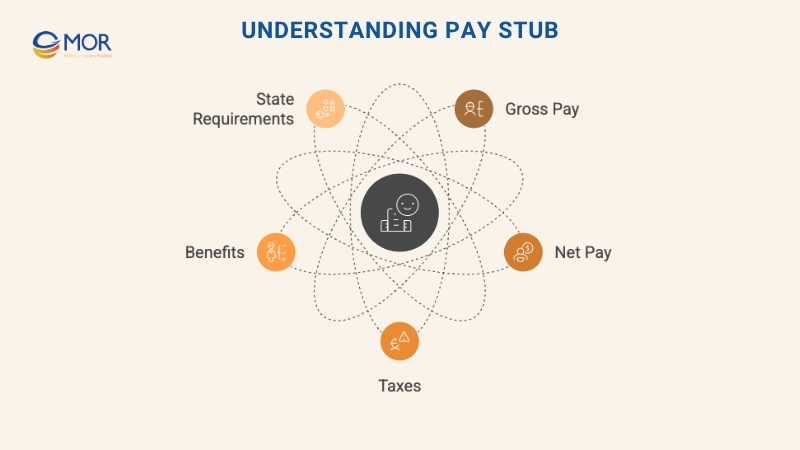

What Is a Pay Stub?

A pay stub shows the full breakdown of what an employee earns and what gets taken out each pay cycle. You’ll see gross pay (before deductions), net pay (after deductions), and withheld amounts for taxes, retirement, health insurance, union dues, and other deductions.

Most companies issue either printed or digital stubs. Printed ones are handed out with checks. Digital ones come from payroll systems. Contractors or freelancers who need documentation for their income often turn to a pay stub generator.

It’s important to know that pay stub rules change depending on where you live. Some states require employers to provide printed stubs, others allow digital versions only if employees agree. A few don’t require them at all.

If you're still wondering, what is a pay stub? Think of it as your personal earnings report. Whether it’s for tax filing, a loan application, or a rental agreement, this document proves income and deductions in one place.

Failing to meet pay-stub rules is expensive. In fiscal year 2024 the U.S. Department of Labor recovered more than $202 million in back wages for almost 152,000 workers.

What Is a Payslip?

A payslip is basically the same as a pay stub. The difference? It’s the term used more often outside the U.S., especially in the UK and other Commonwealth countries. You'll find payslips used by companies that pay hourly workers or temp staff.

A typical payslip lists total hours worked, your hourly rate, and any extras like bonuses or overtime. It may skip some of the detailed breakdown you’d expect on a stub, like FICA or retirement contributions.

That’s why payslip vs pay stub matters. While they serve a similar purpose, their content and format reflect regional norms. A salary pay slip tends to keep it short and focused on hours and rate, while the U.S. pay stub is often more detailed.

So, are payslips and pay stubs the same? Not always. Both document income, but payslips are often linked with hourly roles and simpler summaries, especially when pay is calculated on a week-to-week basis.

What’s The Real Difference Between Pay Stub Vs Payslip?

At first glance, pay stubs vs payslips seem interchangeable. But if you look closer, a few practical differences stand out, especially depending on where and how your team gets paid.

We’ve broken down the key distinctions to help you decide which one fits your business best.

Aspect | Pay Stub | Payslip |

Common Usage | More common in the U.S., especially for salaried employees. Larger organizations prefer pay stubs because they support more detailed reporting. | Typically used in the UK or Commonwealth countries. Payslips are standard for hourly or temporary workers. |

Delivery | Issued on paper or digitally through payroll systems. Most U.S. companies use digital formats now. | Still largely paper-based, especially in smaller firms or where digital tools are limited. |

Content | Shows gross and net pay, tax withholdings, insurance, employer contributions, and YTD totals. | Focuses on hours worked, pay rate, overtime, and any one-time earnings like bonuses. |

It’s easy to see why many businesses mix up the terms. But choosing between a payslip vs pay stub really comes down to your payroll setup and who you’re paying.

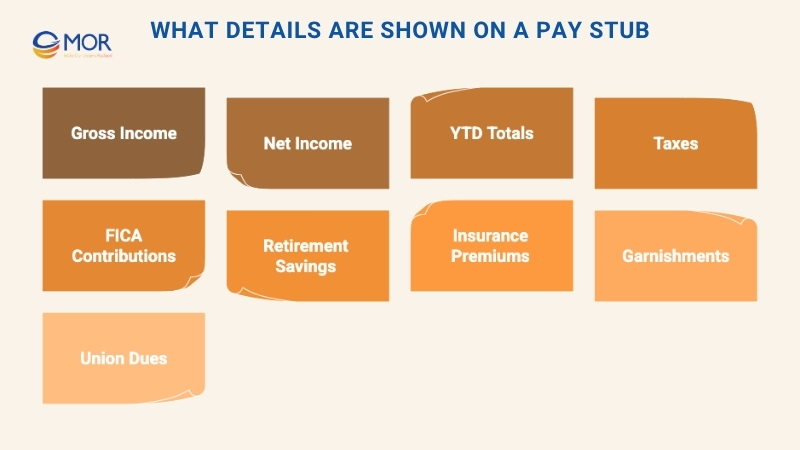

What Details Are Shown On A Pay Stub?

When reviewing a pay stub vs payslip, the biggest difference lies in the level of detail. A pay stub goes deep into the numbers. Here's what you’ll typically find:

- Gross income: This is the full amount an employee earns before anything’s taken out. It covers salary, hourly wages, bonuses, or commissions earned in that pay period.

- Net income: This is the take-home pay. After taxes and deductions, this is what actually lands in the employee’s account.

- YTD totals: Year-to-date summaries track all earnings and deductions since the start of the calendar year. So how to calculate ytd in payslip? Read it now.

- Taxes: Federal, state, and local taxes appear here. Some states skip income tax, so not every stub will show the same info.

- FICA contributions: This covers Social Security and Medicare. Both the employer and employee pitch in to meet the required amounts.

- Retirement savings: 401(k), Roth IRA, or SIMPLE IRA deductions show up on pay stubs when employers offer those benefits.

- Insurance: Premiums for health, dental, vision, or even life insurance are listed when they’re part of your compensation package.

- Garnishments: Court-ordered deductions, like child support or student loan repayments, will be noted here if they apply.

- Union dues: If an employee belongs to a union, these dues get pulled from each paycheck and passed on to the union.

The bottom line? If you’re comparing payslips vs pay stubs, pay stubs deliver a more detailed breakdown that’s especially useful for salaried roles and tax reporting.

Average global payroll accuracy still reaches only about 78%, according to ADP’s 2024 Global Payroll Survey. A broader compilation of 2025 payroll statistics pegs typical accuracy near 80%, showing how much room many firms have to improve.

What Are Pay Stubs Used For?

A pay stub is more than a paycheck breakdown. It's a record that helps with everything from filing taxes to proving your income. When it comes to pay stub vs payslip, this document tends to carry more weight in situations that require detailed financial proof.

Tax Filing

Tax season? Most people double-check their W-2 or year-end statement against their last pay stub. It shows exactly how much income was earned and how much tax was withheld. That’s crucial for filing correctly and avoiding surprises. Employers also use it to verify they’ve met tax obligations for each worker.

That said, mistakes in payroll are more common than many realize. Research from Ernst & Young shows that one in five U.S. payrolls contains errors, and each mistake costs employers about $291 to correct.

HR Dive adds that the average company makes roughly 15 corrections every pay period, which shows how easy it is for payroll issues to pile up. These kinds of errors can throw off tax filings for both employers and employees, making accurate pay stub records essential during tax season.

Renting a Home

Landlords often ask for pay stubs to confirm renters have steady income. It’s a quick way to prove you can cover the rent, and that the money’s coming from a legitimate job. Whether you're salaried or hourly, a recent stub helps back up your claim.

Applying for a Loan

Need a car loan or mortgage? Lenders will likely request a few recent pay stubs. They want to see your gross income and match it against the figure on your application. If everything lines up, you’re more likely to get approved.

When comparing pay stubs vs pay slips in this case, lenders often prefer stubs because they offer more detail. That extra info helps confirm you’re a reliable borrower.

So while it might seem like a formality, your pay stub can open doors, and help close deals.

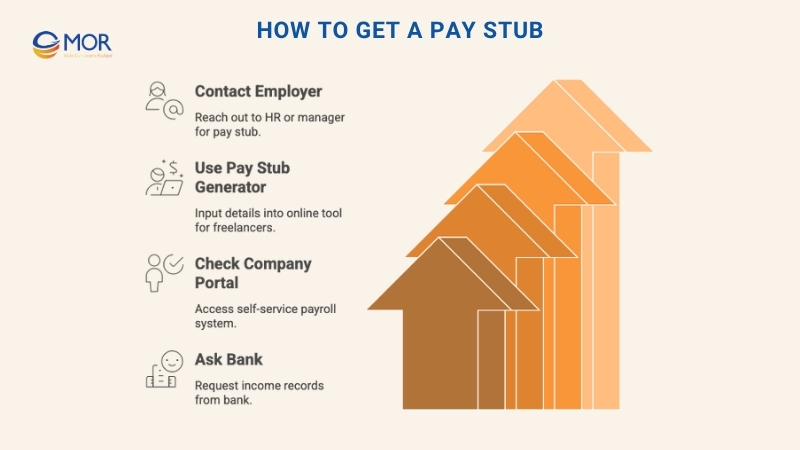

How To Get A Pay Stub?

If you’re comparing pay stub vs pay slip and wondering how to get either, the steps are mostly the same. Let’s walk through your options for retrieving a pay stub specifically.

Ask Your Employer

The most direct method is to request it from your employer or HR department. They might email a digital copy or hand you a printed one, depending on how payroll is handled.

Use a Pay Stub Generator

If you're a contractor or freelancer, generating your own pay stub is easy with an online tool. Just plug in your pay rate, hours worked, and deductions. Even W-2 employees can use these generators, as long as they know the right figures.

These tools use built-in templates to reduce mistakes and help you produce a clean, professional-looking pay stub quickly.

Check Your Company Portal

Many companies use payslip software with a self-service portal. If you're still on the team, log in and download your pay history. This is often the fastest way to find old pay stubs without needing to ask anyone.

Ask Your Bank

Got direct deposit? Some banks may help you pull up income records tied to your account. While it’s not a standard pay stub, the data can often match what’s on your official copy.

Whether you're after a stub for taxes, a rental, or a loan, the process is simple, just depends on your current work setup.

What Details Are Shown On A Payslip?

When comparing a pay stub vs payslip, a payslip usually sticks to the basics. It’s designed to give a quick view of income, especially for hourly roles. That focus makes sense because 55.6% of U.S. wage-and-salary workers were paid hourly in 2024.

Here’s what a standard payslip includes:

- Hourly rate: This shows how much you're paid for each hour worked. It should match your employment contract or offer letter.

- Total hours worked: Employers add up all the hours you clocked in during the pay period. Multiply that by your hourly rate, and that’s your gross pay.

- Bonuses or adjustments: Got a one-time reward or a time-off payout? These appear as line items so you can see they’ve been added to your total.

- Overtime pay: If you worked more than your regular hours, this shows up separately. It reflects any extra compensation earned for going beyond the standard schedule.

When we look at payslips vs pay stubs, it’s clear payslips are more common in roles with variable hours and less complex deductions. They’re short, to the point, and easier for hourly workers to read.

>>> READ MORE: Payslip Template - Free Simple Payroll Solution for SMEs 2025

What Are Payslips Used For?

Just like pay stubs, payslips aren’t just about showing earnings. They’re also used in key life moments when income proof matters.

Loan Applications

Banks and lenders may ask for payslips from the last 3 to 6 months to verify your income. This helps them check if your pay is stable enough to handle a loan. When it comes to payslip vs pay stub, both are valid, but payslips are often used in places where stubs aren’t the norm.

Rental Agreements

Landlords often ask to see a payslip before signing a lease. It confirms your salary and shows that you earn enough to pay rent on time. Most rental agents won’t proceed without it.

Job Changes

If you’re switching jobs, recruiters or HR teams may ask for recent payslips to confirm your current salary. It’s a common request during negotiations, especially in regions where salary data isn’t public.

Tax Prep

In countries where formal year-end summaries aren’t standard, payslips help track total earnings and deductions. This is useful for contractors or temp workers who don’t receive a formal tax slip.

So if you're asking, what are pay slips used for? Think verification, clarity, and convenience, especially in financial and hiring situations.

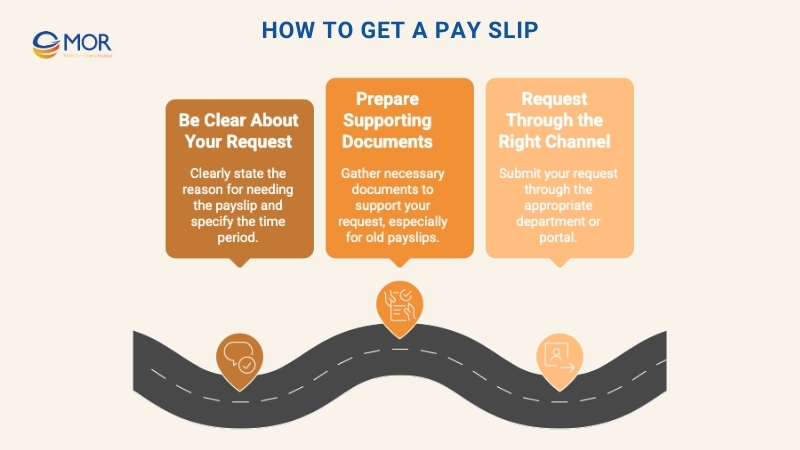

How To Get A Pay Slip?

When it comes to getting a pay stub vs payslip, the steps are nearly identical. But if you're specifically after a pay slip, a few extra details can help speed things up.

Be Clear About Your Request

Let your employer know why you need the document, whether it’s for a loan, visa, or rental. Be specific about the time range too. For example, “I need my payslips from the last six months.”

Gather Any Supporting Documents

If you're requesting old payslips from a past job, you might be asked to show proof. That could be a loan application, a job offer, or rental paperwork. Having those ready helps legitimize your request.

Whether you're getting it from HR, an employee portal, or even a previous employer, the process is straightforward. Just remember, when businesses compare a pay stub vs payslip, it's not about difficulty, just format and function.

How MOR Software Helps You Go Digital With Pay Stubs Vs Payslips?

If you're still managing payroll through spreadsheets or handing out printed slips, you're not just wasting time, you're missing an opportunity to simplify work for everyone.

At MOR Software, we build secure, scalable payroll platforms tailored for both web and mobile. That means your employees can access their pay stubs or payslips anytime, on any device, without calling HR.

Whether you’re dealing with pay stub vs payslip requirements or juggling both, our team ensures the right format is delivered to the right people.

Our engineering teams create custom employee portals and integrate them with your existing systems, whether it's HRM, accounting, or time-tracking. You get:

- Automated pay stub and payslip generator

- Secure self-service access for staff

- Real-time updates on salary, deductions, and bonuses

- Local compliance across regions

Ready to ditch paper and make payroll easier for your team?

Contact MOR Software to build a system that works for the way you work.

Conclusion

Understanding the difference between a pay stub vs payslip isn’t just a matter of terminology. It’s about knowing what fits your business best. Whether you need detailed breakdowns for tax and compliance or simple summaries for hourly workers, the right format helps your payroll stay transparent and professional. Want to simplify payroll and make it easier for everyone to access? Contact MOR Software today.

MOR SOFTWARE

Frequently Asked Questions (FAQs)

Are pay stub vs payslips the same thing?

Mostly, yes. Both show how much you were paid and what was deducted. “Pay stub” is common in the U.S., while “payslip” is used more in the UK and other regions.

Do I need both a payslip and a pay stub?

No. You’ll usually receive one or the other, depending on where you work and how your payroll system is set up. They serve the same purpose.

Can I use a payslip to prove income for a loan?

Yes. Payslips are often accepted as proof of income by banks, landlords, and other institutions, just like pay stubs.

What should I do if I lose my payslip or pay stub?

Ask your employer or HR department. If your company uses a self-service portal, you can usually download past records there. Contractors can use a pay stub generator.

Are digital pay stubs legally valid?

Yes. In most countries, digital copies are accepted as long as they’re accurate, accessible, and secure. Some regions may require employee consent for paperless delivery.

Rate this article

0

over 5.0 based on 0 reviews

Your rating on this news:

Name

*Email

*Write your comment

*Send your comment

1