The Ultimate Payment Gateway Integration Guide for Businesses

Managing payments can make or break a business, and that’s where payment gateway integration becomes essential. From handling multiple methods to keeping transactions secure, the right setup solves the real pain points merchants face every day. This MOR Software’s guide covers integration types and real-world examples to help you choose the best solution.

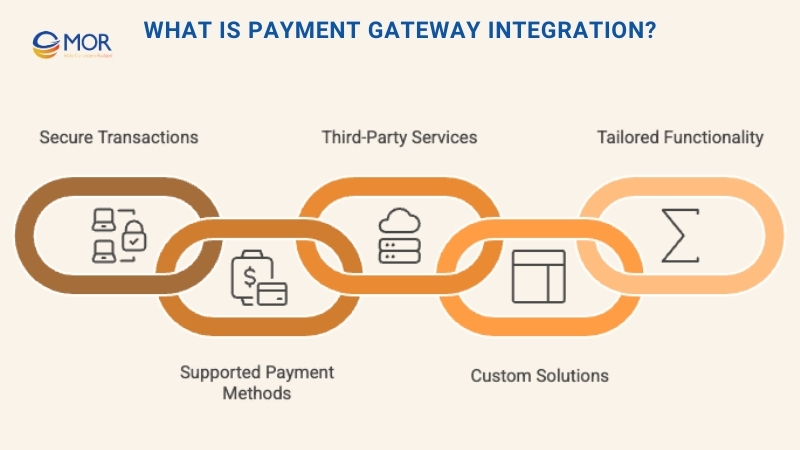

What Is Payment Gateway Integration?

Payment gateway integration refers to the process of linking a company’s digital system with a secure payment provider. The scale of this market is huge. According to McKinsey & Company, the global payments industry brought in about $2.4 trillion in revenue in 2023, after growing at around 7% per year since 2018. Projections show it could climb to $3.1 trillion by 2028.

This connection makes it possible for customers to complete transactions directly on the platform using supported methods, including credit cards, debit cards, digital wallets, or direct bank transfers.

Most businesses rely on third-party services because they are quick to set up and widely accepted. With roughly 70% of online shopping carts abandoned on average, fast, familiar checkout options can materially influence outcomes.

Yet, in cases where companies require advanced functions or industry-specific options, a custom-built solution may be the better path. Custom development gives organizations full ownership of the payment flow, ensures compatibility with unique processes, and delivers tailored functionality that matches exact business goals.

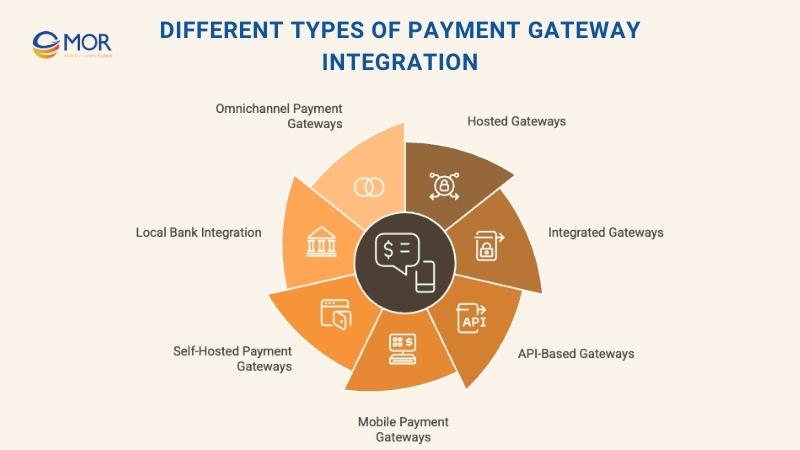

Different Types of Payment Gateway Integration

Businesses can choose from several payment gateway integration models, and each approach comes with its own strengths. Whether you operate an eCommerce store, a subscription platform, or provide online services, knowing these types helps you decide which model fits your operations best.

Making the right choice has real financial benefits. Baymard’s large-scale research shows that simply improving the checkout experience can boost conversions by as much as 35%.

Hosted Gateways

In this setup, the payment process happens on the provider’s external page. Customers are redirected from your site to a secure checkout environment controlled by the gateway. Once they confirm payment, the system sends a transaction response back to your application. This option is popular because it removes the need for you to manage sensitive data directly.

Integrated Gateways

Here, the entire checkout flow stays within your platform. Customers never leave your site, creating a consistent buying experience. The gateway usually provides a JavaScript library that handles tokenization of card information, while server-side API requests complete the process in the background. This approach is preferred by companies looking for brand consistency during checkout.

The payoff can be significant. Stripe’s experiments showed that offering at least one relevant local payment method beyond cards increased revenue by 12% and lifted conversions by 7.4% on average.

API-based Gateways

With this option, developers gain advanced control over payment logic. The gateway exposes RESTful APIs that accept JSON payloads, making it possible to design custom flows. Businesses can configure features like recurring charges, partial refunds, or split payments, ensuring that the system adapts precisely to unique requirements.

Mobile Payment Gateways

These solutions are built for smooth checkout on smartphones and tablets. They usually come with native SDKs for iOS and Android, making integration straightforward. Many also support wallet services like Apple Pay or Google Pay, and rely on device fingerprinting to improve security.

The market numbers underline why mobile-first integration is essential. Mobile already drives about 57% of global eCommerce sales in 2024, and digital wallets are expected to reach $25 trillion and nearly 49% of all online and in-store sales by 2027, according to Red Stag Fulfillment. On the security side, Experian reports that 73% of fraud teams consider device fingerprinting a must-have tool for prevention.

Self-hosted Payment Gateways

With this setup, payment details are collected directly on your server before being passed to the provider. It requires a secure form on the client side, often supported by JavaScript for input validation. On the backend, developers must configure SSL/TLS correctly and use tokenization to protect sensitive data.

Local Bank Integration

This model connects directly with banks’ proprietary APIs. It often depends on protocols such as Open Banking standards or country-specific systems. Authentication is usually handled through OAuth, and in some cases, digital signatures are necessary to verify the transaction.

Omnichannel Payment Gateways

These gateways unify online, in-store, and in-app transactions into one system. A single API allows merchants to manage payments across all channels. Tokenization helps maintain consistent customer profiles, enabling smoother cross-channel experiences.

When evaluating which payment gateway integration works best, align your choice with your top priorities. If you need simplicity, a hosted model is often the fastest option. If you want to keep users on your platform, integrated gateways reduce cart drop-offs. For organizations requiring advanced customization, API-based systems offer full flexibility. And if your customers frequently buy on mobile devices, investing in mobile-focused solutions will pay off.

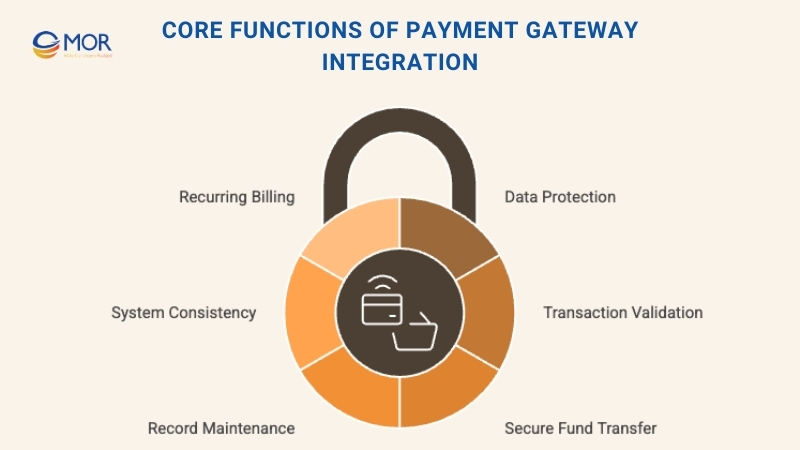

Core Functions of Payment Gateway Integration

Even though there are many kinds of payment gateway integration, the core responsibilities remain the same. Every solution is designed to ensure security, reliability, and accuracy in processing payments.

- Protect sensitive information: Security is the top priority. Gateways apply SSL/TLS encryption and tokenization to safeguard payment data. These measures turn sensitive details into coded information that only authorized systems can read. The risk is significant. Industry forecasts show that global card-payment fraud losses could total around $400 billion over the next decade, which highlights why strong data protection is non-negotiable.

- Validate each transaction: Before approval, the system checks card authenticity, account balance, and possible fraud signals. Tools like CVV checks, AVS validation, and even machine learning help identify unusual behavior and prevent fraudulent activity.

- Transfer funds securely: Once verified, the gateway moves money from the customer’s account to the merchant’s. This process involves authorization and settlement, which typically completes in seconds, though actual deposits may take one or two business days.

- Maintain transaction records: Gateways store a detailed log of all operations. These records support financial reporting, trend analysis, and dispute resolution. Many platforms also include real-time dashboards for monitoring sales performance.

- Enable system consistency: Effective gateways communicate with different applications through APIs, making sure data exchange is accurate and standardized. This consistency ensures smooth operations across your technology stack. In Europe, the new Instant Payments Regulation requires euro transfers to be processed within 10 seconds, 24/7, showing how strict the move toward standardized and instant payments has become.

- Support recurring billing: For subscription-based services, gateways can securely store customer details and handle automated charges. This allows businesses to bill clients at regular intervals without manual effort. Reducing friction is critical here. Visa notes that 62% of UK consumers will abandon a digital purchase if checkout takes longer than 2 minutes, which is why smooth, tokenized rebills are key to keeping renewals consistent.

Together, these functions explain why payment gateway integration services are essential. They make it possible for businesses to move money quickly, securely, and with confidence. Up next, we’ll look at how the process works in practice.

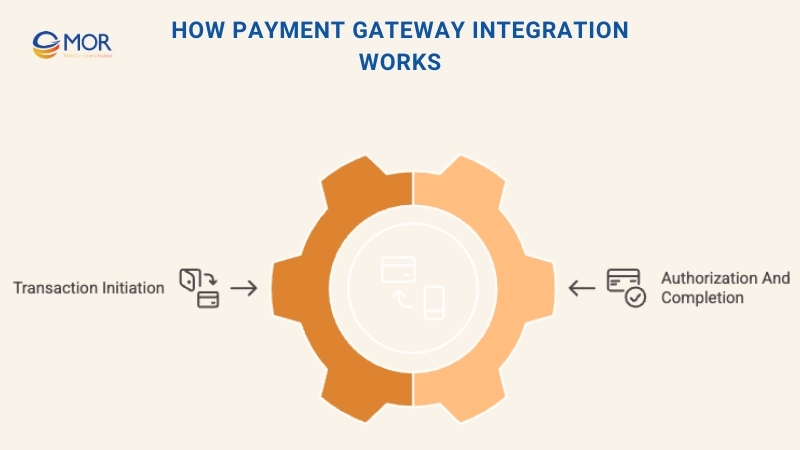

How Payment Gateway Integration Works

We’ve covered the fundamentals, but making the right decision also means knowing how the process unfolds. Online transactions generally move through two key stages that ensure payments are handled securely and efficiently.

Stage 1: Transaction Initiation

When a customer chooses to buy something online, the payment gateway integration begins its work. The focus at this stage is safely collecting and transmitting payment details. The steps include:

- Customers provide their card or wallet information through your checkout page.

- The gateway instantly encrypts this sensitive data using strong security protocols.

- Encrypted details are transmitted securely to the designated payment processor.

This stage forms the foundation of secure online payments. With a properly implemented api integration payment gateway, sensitive customer data remains protected from the very first click.

Next comes the second stage, where the authorization and completion of the transaction take place.

Stage 2: Authorization And Completion

Once the encrypted payment data reaches the processor, a chain of quick communications takes place to verify and finish the transaction. At this point, the payment gateway integration works as the link between your platform, the processor, and the issuing bank:

- The processor reaches out to the customer’s bank or card network.

- The bank reviews account balance, card status, and security checks before approving or rejecting the request.

- That decision is sent back through the gateway and displayed on your site in real time.

- If approved, the settlement process starts, moving funds from the customer’s account into your merchant account.

While each solution has its own technical approach, the general flow is consistent. Some advanced gateways also include extra fraud detection layers or enhanced identity verification at this stage.

Understanding both stages highlights why selecting the right online payment gateway integration matters. It determines how secure each payment is, how fast customers can complete purchases, and how reliable your revenue collection will be.

Comparing Leading Payment Gateway Integration Options

Every provider approaches payment gateway integration differently, offering a mix of benefits and trade-offs. Some stand out for affordability, others for global reach or advanced customization. To make the right choice, it’s important to look at how each handles pricing, available integration methods, and distinctive features. This way, you can identify the gateway that best supports your payment integration strategy.

Authorize.Net

Authorize.Net has been a trusted name in online payments since 1996, providing businesses with a reliable and well-rounded platform. Its tools include the Advanced Fraud Detection Suite (AFDS), recurring billing through a customer information manager, multi-currency support, and flexible checkout integrations.

The payment gateway integration process with Authorize.Net can be more technical compared to some newer providers, but it also delivers higher levels of customization and control for businesses that need it.

Pros:

- Works with a wide range of banks and merchant accounts

- Strong security and fraud prevention features

- Responsive customer service

Cons:

- Monthly fees in addition to transaction charges

- Setup can be more involved than newer competitors

Pricing: $25 monthly gateway fee + 2.9% + $0.30 per transaction for the all-in-one plan, or $25 monthly + $0.10 per transaction for gateway-only access.

Best for: Established companies that want a dependable payment gateway integration with strong security and advanced customization.

PayPal

PayPal has been a leader in online payments since 1998, offering a trusted and widely used payment gateway integration. It supports one-click payments for registered accounts, processes debit and credit cards, and handles over 100 currencies with 10+ localized payment methods. Its customizable checkout options create a smooth user experience, while seller protection adds an extra layer of security.

Setting up PayPal requires little technical skill, making it one of the most accessible choices for businesses of all sizes. Today, millions of merchants, including global brands such as Airbnb, Spotify, and DoorDash, rely on PayPal. With more than 400 million active accounts worldwide, its reputation is unmatched.

Pros:

- Highly recognizable and trusted by customers globally

- Quick setup with minimal technical knowledge required

- Built-in buyer and seller protection programs

Cons:

- Higher fees than some competitors

- Funds may occasionally be held during security reviews

Pricing: The standard fee is 2.9% + $0.30 per US transaction, plus an extra 1.5% for international payments. There are no monthly charges for standard accounts.

Best for: Startups and small to mid-sized companies that want a simple, globally recognized payment gateway integration with broad customer trust.

Square

Square has grown into a versatile payment gateway integration solution that covers both online and offline transactions. It combines payment processing with a built-in point-of-sale system, giving businesses a single platform for handling sales across multiple channels. Square also includes valuable extras such as reporting tools, analytics, and even a free online store builder.

The platform is especially popular with small businesses and independent sellers but has also been adopted by larger companies, including Whole Foods and Starbucks, for specific payment operations.

Pros:

- Simple and user-friendly payments system

- Provides business management and reporting tools

- Works well for both in-store and online transactions

Cons:

- Not suitable for high-risk businesses

- Limited customization compared to developer-heavy options

Pricing: Fees depend on the payment method. Rates include 2.6% + $0.10 for in-person sales, 2.9% + $0.30 for online transactions, and 3.5% + $0.15 for manually keyed payments. There are no monthly fees for standard accounts.

Best for: Retailers, restaurants, and service providers who need an integrated system for both physical and online sales, supported by easy-to-use payment gateway integrations.

Amazon Pay

Amazon Pay leverages the trust of the Amazon brand to provide a familiar checkout experience for millions of online shoppers. It supports one-click transactions for existing Amazon account holders, includes fraud protection powered by Amazon’s Protect technology, offers multi-currency capabilities, and even enables voice-activated payments through Alexa.

The voice feature is particularly useful for businesses catering to tech-savvy customers or those who value accessibility, making the checkout process easier and faster.

Pros:

- Strong brand recognition that builds customer trust

- Quick checkout for Amazon users

- Voice-enabled transactions for modern and accessible shopping experiences

Cons:

- Limited flexibility for customization

- Some buyers may hesitate to use Amazon credentials on third-party sites

Pricing: The standard rate is 2.9% + $0.30 per US transaction, along with a $0.30 authorization charge. For international purchases, an additional 3.9% fee applies.

Best for: eCommerce companies aiming to tap into Amazon’s huge customer base, streamline payment gateway integration, and experiment with emerging features such as voice commerce.

As shown, businesses can choose from a wide range of ready-made payment gateway integrations. Still, in cases where no single provider covers all requirements, combining solutions or developing a custom setup may be the smarter choice. Custom payment integration allows companies to bring together advanced APIs, analytics, and even voice technology to create a tailored solution.

How To Approach Payment Gateway Integration As A Decision-Maker

Payment gateway integration can be technically demanding for developers, since each provider has its own requirements and processes. While the engineering team manages the coding and system setup, business leaders need a clear understanding of how it works. Having this knowledge helps in building accurate budgets, setting expectations, and making informed choices about which provider to adopt.

Review Workflows And Compliance Needs

Before comparing prices or checking technical specifications, start with your company’s unique needs. The way a payment system is integrated can differ greatly depending on your industry, customer base, and sales model. Some businesses only require a basic checkout setup, while others need more advanced payment gateway integrations with custom features and compliance standards.

Below are five key factors to evaluate when preparing to integrate a payment gateway:

Cost Structure And Transaction Limits In Payment Gateway Integration

Consider the total expenses, including setup fees, monthly charges, and per-transaction costs. Certain providers are better for handling micropayments, while others are designed for large-value transactions. Confirm that the solution you select can cover the full range of your business needs, from small everyday purchases to high-ticket items.

Provider | Transaction Limits |

Authorize.net | Sandbox accounts: $5,000 total / $100 per transaction. Other account types use Amount Filter to set limits. |

PayPal | Up to $60,000 in a single transaction, though in some cases the limit may be capped at $10,000. |

Square | Maximum of $50,000 per transaction. Larger amounts must be divided into multiple installments. |

Stripe | New users have an additional weekly limit of $10,000. General limit is $10,000 per transaction. |

Amazon Pay | $500 per customer each month. |

Supporting Multiple Payment Methods For Global Reach

Your chosen gateway should handle a broad mix of payment types. A CC payment gateway, mobile wallets, and even mobile-focused solutions are expected today. For businesses selling internationally, multi-currency support is essential to provide a smooth checkout experience for global customers.

Provider | Payment Methods Supported |

Authorize.net | Visa, MasterCard, Discover, American Express, JCB, PayPal, Apple Pay, eCheck |

PayPal | Instant balance transfer, instant bank transfer, PayPal Credit, instant card payment, eCheque |

Square | Magstripe or chip cards, mobile wallets like Apple Pay, Google Pay, Samsung Pay, Afterpay |

Stripe | Visa, MasterCard, American Express, Discover, JCB, Diners Club, China UnionPay, debit cards |

Amazon Pay | Various credit, debit, and gift cards, plus FSA, HSA, and SNAP EBT cards |

Flexibility Of APIs And Integration Options

Consider how well the provider fits into your existing systems. Leading services offer simple website integrations along with strong payment gateway api integration options. This flexibility allows developers to tailor the setup and support advanced workflows as your needs evolve.

Provider | Integration and API Flexibility |

Authorize.net | XML/JSON API options, webhooks for notifications, customer profiles with recurring billing, transaction reporting API, REST API with modern endpoints |

PayPal | Custom checkout flows, direct API integration, subscription handling, marketplace solutions, wide range of API endpoints |

Square | Ready-made checkout options, custom API integration, POS system integration, inventory management API, customer tracking, order management system |

Stripe | Elements UI toolkit integration, direct API access, mobile SDK support, advanced payment flows, multi-currency processing |

Amazon Pay | Standard integration methods, express integration, mobile integration capability, recurring payment support, order management system |

Security Standards And Regulatory Compliance

Protecting customer information is non-negotiable. Choose a PCI DSS–compliant solution that uses encryption and tokenization. Many providers also include fraud detection features to strengthen your defenses against suspicious activity.

Provider | Security & Compliance |

Authorize.net | PCI DSS compliance tools, advanced fraud detection suite, enhanced security features, signature key system, encrypted transaction handling, secure token system |

PayPal | Built-in fraud protection, encrypted transactions, PCI compliance support, buyer/seller protection, risk management tools, data encryption standards, secure authentication |

Square | End-to-end encryption, fraud prevention system, PCI compliance handling, secure hardware integration, risk monitoring, dispute management |

Stripe | Strong authentication methods, advanced fraud prevention, PCI compliance automation, real-time monitoring, machine learning fraud detection, secure payment handling |

Amazon Pay | Amazon security infrastructure, fraud protection system, A-to-z guarantee coverage, PCI compliance handling, risk assessment tools, secure data handling, authentication protocols |

Merchant Accounts And Platform Compatibility

Some gateways include merchant accounts, reducing setup steps and simplifying your payment gateway integration services. Also confirm whether the gateway aligns with your products, whether digital or physical, and supports your ecommerce payment platforms. This ensures smooth operation without workarounds.

Provider | Merchant Integration & Platform Compatibility |

Authorize.net | Works with major shopping carts, supports multiple CMS integrations, various programming languages, EMV and MSR integration, mobile SDK integration, and compatibility with popular eCommerce platforms |

PayPal | Wide platform compatibility, ready-made shopping cart plugins, cross-platform SDK support, mobile integration options, easy CMS integration, and worldwide merchant acceptance |

Square | Unified dashboard for all platforms, simple eCommerce platform integration, POS hardware compatibility, mobile payment acceptance, restaurant and retail system integration, and cross-platform functionality |

Stripe | Extensive platform compatibility, multiple CMS integrations, framework-specific libraries, cloud platform integration, marketplace enablement, SaaS platform support, and enterprise system compatibility |

Amazon Pay | eCommerce platform plugins, shopping cart integration, web and mobile compatibility, voice commerce capability, multi-platform support, CMS integration, and cross-border transaction support |

Keep long-term growth in mind, too. The right gateway should scale with your expansion and adapt to new markets. With these basics clear, it’s time to explore the most popular providers, weigh their pros and cons, and review how their pricing structures may fit your business.

Address The Technical Side Of Payment Gateway Integration

Modern api integration payment gateway solutions range from easy plug-and-play setups to highly customized builds. The right choice depends on your team’s technical expertise and the level of control your business requires.

When planning the integration, consider these factors:

- Platform compatibility across your existing systems

- API functionality for secure credit card processing

- Internal resources and developer capacity for implementation

- Security protocols and compliance with global standards

- Realistic timelines and clear milestones for deployment

Keep in mind that the most complex setup is not always the most effective. In many cases, a straightforward payment gateway integration works better than a feature-packed option that is difficult to manage. At MOR Software, our engineers have guided clients through full HRM models, helping them align technical requirements with business goals.

Assess The True Cost Of Payment Gateway Integration

The overall price of payment gateway integration involves more than just per-transaction fees. Each provider follows its own business model, which includes multiple expenses that influence profitability. Decision-makers should evaluate both the upfront setup and the long-term financial impact.

Key cost elements to review include:

- One-time setup charges and monthly subscription fees

- Transaction-based costs for each payment processed

- Currency conversion rates for international sales

- Development and integration expenses during implementation

- Ongoing technical support or account management costs

It’s also worth noting potential savings. Advanced features such as fraud detection or automated reconciliation can offset higher fees by lowering manual effort and reducing errors. In many cases, choosing a more comprehensive payment integration solution results in greater efficiency and long-term savings.

Create A Step-By-Step Integration Strategy

A smooth payment gateway integration depends on solid planning and structured execution. Whether you’re setting up a straightforward solution or implementing a more complex multiple payment gateway integration, a clear roadmap keeps the process efficient and reduces risk.

Typical phases to follow include:

- Setting up the development environment

- Running integration tests and validating functionality

- Conducting user acceptance testing with real scenarios

- Fine-tuning performance for speed and reliability

- Launching the system and monitoring results closely

Many providers offer test environments, such as Authorize.Net’s Sandbox or Stripe’s Test Mode. Using these before going live allows you to spot and fix issues without affecting customers, ensuring the final rollout is stable and dependable.

Practical Tips For Smooth Payment Gateway Integration

Selecting and implementing the right payment gateway integration can make a major difference for your business. Keep in mind that costs, setup steps, and support levels can vary greatly between providers. In some cases, adopting integrate multiple payment gateways may be the smarter move, giving you more flexibility and wider customer reach.

The ideal setup depends on your business model. A company running payment portals for support services will have very different needs compared to an online retail store. What matters most is aligning the gateway with your website architecture and ensuring the features match your sales strategy.

Security should remain a top priority. Look for PCI DSS compliance, tokenization, and encryption to protect sensitive data. Whether you’re adding a gateway into your site’s source code or deploying it across existing platforms, most providers supply clear documentation and support teams to guide you. Remember, the ultimate goal of any payment integration is not only technical success but also creating a frictionless experience that keeps customers coming back.

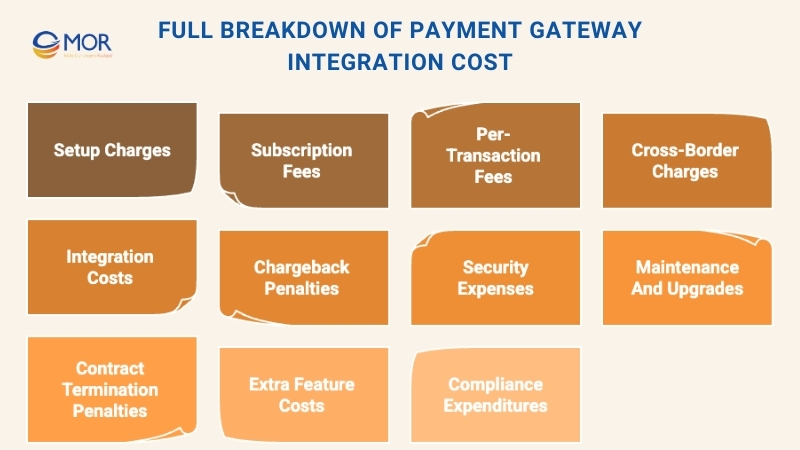

Full Breakdown Of Payment Gateway Integration Cost

Building a custom payment platform isn’t required for most companies, but the true cost of payment gateway integration is often more than it first appears. To budget accurately and choose a cost-effective option, decision-makers need to account for both direct and indirect expenses. Below are the most common factors that influence total cost.

Setup Charges

Some providers require a one-time setup fee to activate services. The amount typically depends on brand reputation and available features.

Subscription Fees

Gateways may charge a recurring monthly or annual fee. This could be a flat rate or vary based on transaction volume.

Per-Transaction Fees

Most solutions charge a percentage per transaction, sometimes with a fixed rate added. These fees can vary depending on the best payment gateway in USA or other markets.

Cross-Border Charges

For international transactions, extra fees apply for handling multiple currencies or payments from overseas customers.

Integration Costs

Many platforms offer plugins for popular CMS and eCommerce systems, but custom development or specialized gateway integrators will raise expenses.

Chargeback Penalties

When disputes lead to chargebacks, providers often add administrative fees to cover costs and encourage secure practices.

Security Expenses

Investing in SSL certificates, tokenization, or fraud detection may involve additional costs, but these are necessary for safe transactions.

Maintenance And Upgrades

Gateways frequently update APIs or add features. Businesses should budget for periodic updates to keep the system compliant and functional.

Contract Termination Penalties

Some providers impose cancellation fees if you switch platforms before your contract ends.

Extra Feature Costs

Advanced analytics, dedicated customer support, or premium fraud protection often come at an added price.

Compliance Expenditures

Meeting PCI DSS and regional regulatory standards may require adjustments to your setup, creating further costs.

Real World Case Studies On Payment Gateway Integration

Looking at successful payment gateway integration examples highlights how businesses improve both internal operations and customer experiences. Below is one case that demonstrates the impact of choosing the right solution.

Walmart & PayPal

Walmart Marketplace wanted to strengthen its support for third-party sellers by improving payout flexibility and creating a more reliable platform experience.

Solution

In 2019, Walmart adopted PayPal’s Hyperwallet system to handle seller payouts. This integration provided multiple payout methods while leveraging PayPal’s global recognition and credibility.

Outcome

The addition of Hyperwallet attracted more sellers to the marketplace, simplified financial operations, and improved trust between buyers and merchants. It also advanced Walmart’s larger goal of building a high-quality seller ecosystem.

Lyft & Stripe

Lyft faced growing demand from drivers who wanted faster payouts instead of waiting for the standard weekly schedule. The challenge was to create a solution that allowed flexible payments without causing service interruptions.

Solution

Lyft worked with Stripe to introduce Express Pay, a feature that let drivers cash out earnings whenever they preferred, even within hours of completing a ride. This payment gateway integration provided both convenience and speed.

Outcome

In just six months, more than 40% of drivers adopted Express Pay, strengthening Lyft’s appeal and helping attract new drivers to the platform. The integration also reinforced Lyft’s reputation for being responsive to the needs of its workforce.

Due South & Square

As part of its online expansion, Due South needed a payment system that was simple to adopt yet powerful enough to support growth. Many existing solutions were either designed only for online retailers or too complex for fast implementation.

Solution

In 2020, Due South introduced an online store using Square’s payment gateway integration. The system was connected directly with their inventory, ensuring product availability was always accurate and preventing overselling issues.

Outcome

By adopting Square, Due South maintained uninterrupted business operations and increased online revenue. The case highlighted how a properly integrated gateway can support smooth transactions and drive eCommerce success.

MOR Software's Expertise In Payment Gateway Integration

At MOR Software JSC, we have delivered secure and reliable payment gateway integration for clients across industries such as eCommerce, finance, healthcare, and mobility. Our teams combine strong technical knowledge with a proven track record in building scalable systems that handle high transaction volumes without compromising performance or security.

We support a wide range of solutions, from hosted and API-based gateways to custom integrations with banks and regional payment providers. Using technologies like Java, .NET, Python, React, and cloud services such as AWS, we design systems that guarantee data protection and compliance with global standards like PCI DSS.

Our integration projects have included:

- Liqpay integration for a transportation company, enabling seamless ticket booking and payments.

- Stripe and PayPal API integration for an online marketplace, supporting cross-border sales and flexible checkout options.

- Multi-gateway setups for travel platforms, ensuring redundancy and reliable service even during peak demand.

- Custom Salesforce and Slack integration to automate workforce payment and attendance processes.

Through applying Agile and Scrum practices, we deliver integrations quickly while maintaining quality through continuous testing and monitoring. With ISO 9001:2015 and ISO 27001:2013 certifications, every project we deliver is built with scalability, transparency, and security in mind.

Conclusion

Successful payment gateway integration is more than just connecting systems; it’s about creating secure, scalable, and user-friendly transactions that support business growth. From eCommerce to finance, every industry benefits when payments run smoothly. At MOR Software, we deliver tailored integration projects backed by proven expertise and global standards. Ready to upgrade your payment systems? Contact us today to discuss your project with our team of experts.

MOR SOFTWARE

Frequently Asked Questions (FAQs)

What is API integration for payment gateways?

Payment APIs are sets of tools that allow developers to embed payment functions directly into apps or websites. This makes it possible for customers to pay without being redirected, which helps reduce cart abandonment.

What are the different types of payment integration?

The main options include hosted payment gateways, self-hosted gateways, API-driven gateways, and direct gateways. Each option differs in how complex it is to set up, how much it can be customized, and the kind of experience it delivers to users.

What is an integration gateway?

An integration gateway is a system that manages how messages are sent and received between connected platforms through PeopleSoft Integration Broker.

Is Google Pay a payment gateway?

Yes. Google Pay provides an API that supports eCommerce platforms. Merchants using a hosted checkout page through a processor, gateway, or platform partner can integrate Google Pay’s checkout service.

Which is the best payment gateway integration?

Some of the most widely used options are:

- Stripe: Handles everything from one-time payments to subscriptions.

- PayPal: A trusted name, simple setup, and broad currency support.

- Authorize.Net: Offers strong reliability and fraud tools.

- Square: Combines payment processing with POS features.

- Braintree, 2Checkout, Worldpay, and Adyen are also leading choices.

What is the difference between payment gateway and payment API?

A payment API is code that links your site to an external payment gateway. The API transmits the data, while the gateway itself, hosted by a financial services provider, processes the payment on its own servers.

How can I integrate a payment gateway?

Before integration, a business must first open a merchant account with a bank. If using a third-party gateway like PayPal or Stripe, a merchant account with that provider is also required.

What is API gateway integration?

An API gateway acts as a central hub for handling authentication and authorization. It can work with providers like OAuth, OpenID Connect, or SAML to confirm user identities and control access to resources.

Who is the biggest payment gateway?

Top providers by size and usage include Stripe, PayPal, Adyen, and Authorize.Net. Their fees and ratings vary, but Stripe and PayPal remain two of the most widely adopted.

How hard is it to integrate a payment gateway?

Integration can be technically demanding. Businesses often run into problems like API mismatches, errors in setup that cause downtime, or transaction failures due to gateway issues.

Can I create my own payment gateway?

It is possible, but it requires forming agreements with banks and credit card companies. These relationships can be difficult to establish, especially for smaller businesses, and usually involve navigating detailed financial contracts.

Rate this article

0

over 5.0 based on 0 reviews

Your rating on this news:

Name

*Email

*Write your comment

*Send your comment

1