Top 10 Most Common Payroll Mistakes/Errors And How To Avoid Them

Payroll mistakes happen more often than most businesses expect, and even small slip-ups can turn into costly payroll mistakes. In this guide, MOR Software will highlight the top 10 most common payroll mistakes and share how to avoid them.

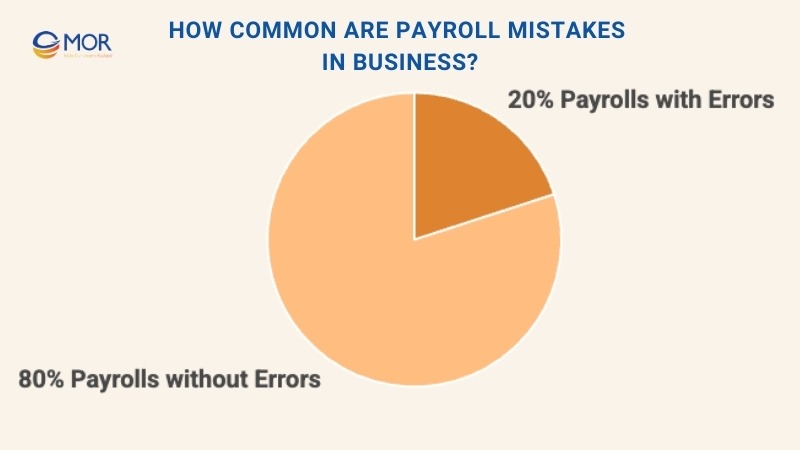

How Common Are Payroll Mistakes In Business?

Research shows that nearly one out of five company payrolls each year includes some form of error. These payroll mistakes often stem from issues like duplicate data entry or simple oversight, yet they all lead to the same problem: wasted money and effort.

Large blunders are easy to notice, but it’s the smaller, repeated missteps that hurt profitability and disrupt workflows the most. Over time, these small payroll errors stack up, cutting into both ROI and employee productivity.

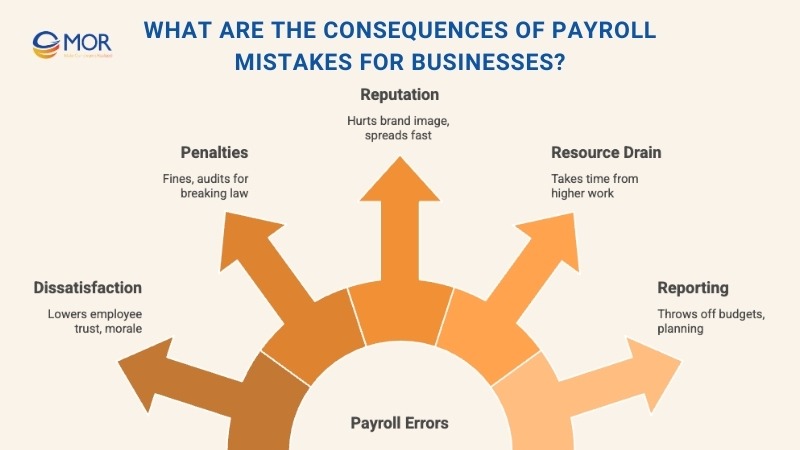

What Are The Consequences Of Payroll Mistakes For Businesses?

Before looking at the most common payroll mistakes, it’s important to see how errors affect both employees and the company:

- Employee dissatisfaction: A short paycheck or late payment quickly damages trust and lowers morale.

- Legal and financial penalties: Breaking payroll mistakes law can lead to expensive fines and audits.

- Reputation damage: Word spreads fast, and payroll problems can hurt your brand image.

- Resource drain: Fixing errors takes time away from higher-value work.

- Inaccurate reporting: A single payroll discrepancy can throw off budgets and planning.

According to the American Payroll Association, 40% of small businesses face IRS penalties for payroll errors each year, averaging $845. These payroll issues not only cause stress for staff but also create turnover risks.

A study by Ernst & Young found that a single payroll error costs a company about $291 to correct. For a business with 1,000 employees, such errors can accumulate to $922,131 annually, while a business with 5,000 employees might lose over $4.5 million per year to these mistakes.

For employers, the cost of rework reduces productivity and chips away at growth opportunities. That’s why preventing errors and investing in accurate systems is key for long-term stability.

Top 10 Most Common Payroll Mistakes Business Shouldn’t Ignore

Let’s break down the common payroll mistakes that cause the biggest problems and see how to prevent them.

1. Misclassifying Employees

One of the most costly payroll mistakes is getting employee classification wrong. The Fair Labor Standards Act (FLSA) requires workers to be correctly categorized as exempt or non-exempt, and errors here often trigger legal penalties and compliance risks.

Why it happens: Some companies misclassify employees, either to cut costs on taxes and benefits or because they don’t fully understand the rules. This type of payroll mistake leaves businesses vulnerable under both federal and state laws.

How to avoid it:

- Review IRS worker classification rules carefully

- Audit employee classifications on a regular basis

- Get professional payroll advice from legal experts if status is unclear

- Use IRS Form SS-8 to confirm a worker’s proper classification

Pro tip: State regulations can be stricter than federal guidelines, so HR and management teams should receive consistent training. This helps ensure compliance and prevents repeated payroll errors across the organization.

2. Errors In Overtime Calculations

Calculating overtime isn’t always straightforward, especially when multiple pay rates, shift premiums, or non-discretionary bonuses are involved. A single mistake can create a payroll discrepancy that frustrates employees and risks non-compliance.

Why it happens: These payroll mistakes often occur because labor laws are misunderstood, manual entries slip through, or companies continue relying on outdated payroll systems. Each of these increases the chance of costly miscalculations.

How to avoid it:

- Review the Fair Labor Standards Act (FLSA) overtime requirements closely

- Use automated time-tracking tools that remove guesswork

- Update overtime rules and policies on a consistent basis

- Provide training for managers on accurate timekeeping and overtime approvals

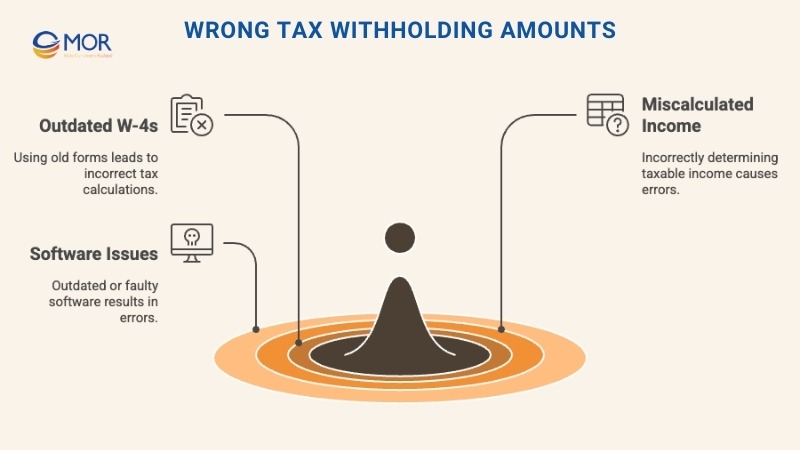

3. Wrong Tax Withholding Amounts

Incorrect tax withholdings create trouble for both employers and staff when tax season arrives. These payroll mistakes are especially harmful because they may not surface until filing time, when fixes are harder and more costly.

The updated W-4 form introduced in 2024 added complexity, changing how employees share their withholding choices and making compliance harder for companies.

Employers should guide staff clearly on completing forms and even run short sessions during onboarding or annual enrollment. Special cases like supplemental wages, fringe benefits, and deferred compensation also need close attention, as they affect calculations.

Why it happens: Errors stem from outdated W-4s, miscalculated taxable income, or payroll software that isn’t updated properly.

How to avoid it:

- Remind employees to review and refresh their W-4 forms often

- Track changes in tax laws and update payroll systems quickly

- Run audits of tax withholdings throughout the year

- Use reliable payroll tools that adjust tax tables automatically

Pro tip: Encourage staff to use the IRS Withholding Estimator to confirm accuracy. Remind them to update after major life changes, which helps prevent costly payroll issues during tax season.

4. Missing Payroll Deadlines

Failing to run payroll on time damages morale, risks breaking payroll mistakes law, and can expose businesses to penalties. Some states take this seriously; in Illinois, late payments can trigger both civil and criminal charges.

Repeated delays may also attract unwanted tax audits. To stay compliant, companies should have a payroll continuity plan to cover emergencies such as system downtime or sudden staff absences.

Why it happens: These payroll mistakes usually result from weak planning, cash flow problems, or simple oversight in administration.

How to avoid it:

- Create a detailed payroll calendar and follow it closely

- Use automated alerts and reminders for key payroll dates

- Keep enough reserves on hand to cover payroll obligations

- Prepare a backup process to ensure payroll continues smoothly during disruptions

5. Mishandling Garnishments And Deductions

Improperly managing wage garnishments or deductions creates both legal and financial risks. Each type of garnishment, whether child support, tax levy, or another order, comes with different rules, limits, and priorities.

Federal and state laws also protect employees by capping garnishments based on disposable income. Employers must not only calculate correctly but also send payments on time, or they risk liability.

Did you know? ADP reports that about 7% of U.S. employees have wages garnished, with child support being the leading cause.

Why it happens: Miscommunication across departments, manual entry mistakes, or a weak grasp of garnishment rules often lead to this payroll mistake.

How to avoid it:

- Build a consistent process for managing garnishment orders

- Train payroll staff thoroughly on garnishment procedures

- Use payroll systems that automate calculations and payments

- Keep garnishment records updated and review them often

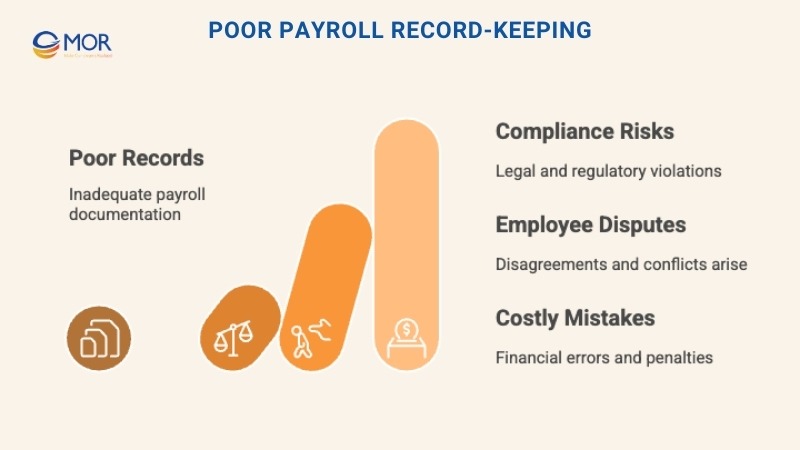

6. Poor Payroll Record-Keeping

Failing to maintain proper payroll records creates compliance risks and sparks disputes with employees. Records such as hours worked, pay rates, and wage adjustments are vital for both compliance and business planning.

Detailed files also make it easier to resolve disagreements quickly and meet retention rules, like the FLSA’s requirement to keep payroll data for three years and certain benefits records for six.

In Illinois, Form I-9 must be stored for three years after hire or one year after the worker leaves. Organized records prevent costly payroll mistakes, support legal compliance, and give HR reliable data for decision-making.

Why it happens: A lack of systemized processes, continued use of paper-based files, or poor backup practices often cause this type of payroll mistake.

How to avoid it:

- Adopt a secure digital record-keeping solution

- Back up payroll data regularly to avoid loss

- Follow federal and state-specific retention policies

- Perform periodic audits to catch and fix gaps early

7. Mistakes In Paid Time Off (PTO) Tracking

When PTO isn’t tracked correctly, employees may be overpaid or underpaid. Managing vacation, sick leave, and personal days adds complexity, and some states impose strict rules for paid sick leave accrual and use.

Each policy choice, carryover, “use it or lose it,” or payout, has payroll implications. Even with so-called unlimited PTO, accurate tracking is still required for compliance and fairness. Providing regular updates on balances helps employees plan time off and prevents a year-end rush.

Why it happens: These payroll mistakes usually stem from unclear PTO policies, manual tracking errors, or poor coordination between HR and payroll teams.

How to avoid it:

- Use an automated PTO tracking system to prevent payroll errors

- Share PTO rules clearly with employees

- Reconcile PTO balances on a regular basis

- Connect PTO tracking directly to payroll for consistency

8. Incorrect Final Paychecks

Mistakes in final paychecks can spark disputes and hurt a company’s reputation. These payments are rarely just base wages. They may also include prorated bonuses, commissions, reimbursements, or unused vacation payouts.

Timing matters too, since many states require final pay within strict deadlines that differ for resignations and terminations.

Did you know? The American Payroll Association reports payroll processing error rates in the U.S. range from 1–8%. Even at the low end, those mistakes can snowball into costly overpayments, filing errors, or compliance failures.

In California, for example, final wages must be paid immediately if an employee is terminated and within 72 hours if they resign. Employers should also understand which deductions are lawful, such as recovering outstanding loans. A clear process and staff training reduce risk and keep pay practices consistent.

Why it happens: Overlooking accrued PTO, bonuses, or other earned compensation leads to this payroll mistake.

How to avoid it:

- Use a detailed checklist for handling final pay

- Stay updated on state rules for final paycheck deadlines

- Verify calculations carefully before processing

- Assign a second reviewer to confirm the final amount

9. Overlooking State And Local Payroll Taxes

Forgetting state or local tax rules is another payroll mistake that leads to penalties. Employers are responsible for more than federal taxes. They must also handle unemployment insurance, disability insurance, and local levies.

The challenge grows for businesses with remote teams or employees spread across different states, where tax rates and filing rules vary. Since regulations change frequently, companies need to track updates and prepare for new obligations when entering fresh markets.

Why it happens: Many employers lack awareness of regional tax requirements, especially when managing staff in multiple jurisdictions.

How to avoid it:

- Stay current on tax laws in every state or city where employees work

- Use payroll systems that calculate and file state and local taxes automatically

- Seek help from local tax professionals for multi-state compliance

- Review and update tax compliance processes regularly to avoid costly payroll mistakes

10. Mishandling Payroll For Remote Employees

The growth of remote work has created new payroll issues for businesses. Employees working across state lines or in different countries face varied tax and labor laws. While some states have reciprocal tax agreements, many do not, making compliance harder.

International arrangements add another layer of complexity with foreign tax obligations and benefits management. Tracking employee locations is critical to ensure accurate withholding and compliance. Clear and adaptable policies help companies avoid mistakes as remote work models continue to expand.

Why it happens: Employers may overlook tax requirements in new jurisdictions or fail to register properly when staff relocate.

How to avoid it:

- Build clear policies for remote work setups

- Stay updated on tax rules in every state or country where employees work

- Consider partnering with a Professional Employer Organization (PEO) for complex cases

- Update remote work and payroll procedures regularly

Pro tip: When staff work outside their assigned office location, new state tax withholdings, unemployment insurance, and workers’ comp rules may apply. Tracking employee work locations and duration prevents this payroll mistake from becoming a liability.

Let MOR Software Help Businesses Process Payroll For Your Organization

Payroll mistakes often come from outdated systems or limited in-house expertise. That’s where MOR Software can step in. We specialize in building tailored payroll and HR software solutions that simplify compliance, reduce errors, and give companies full visibility into their workforce costs.

With our team of skilled developers, QA engineers, and consultants, we create web-based platforms that handle everything from salary calculations and tax deductions to paid time off tracking and reporting. Our approach follows Agile and Scrum, ensuring fast delivery, transparency, and scalability as your business grows.

We don’t just provide development services, we stay with you throughout the payroll system’s lifecycle. That includes integration with existing tools, automated testing, cloud deployment for security and speed, and ongoing maintenance to keep your solution compliant with changing regulations.

MOR Software has proven expertise across industries, from finance and manufacturing to healthcare and retail. Whether you need a custom payroll platform or want to modernize an existing system, our solutions are built to help businesses process payroll with accuracy and confidence.

Contact us today to discuss how we can design a payroll solution tailored to your business needs.

Conclusion

Payroll mistakes can drain resources, hurt compliance, and damage trust if left unchecked. By understanding the most common payroll mistakes and taking steps to prevent them, businesses can save time, avoid penalties, and keep employees satisfied. With MOR Software as your technology partner, you gain a reliable payroll system tailored to your needs and built to grow with your organization. Contact us today to start simplifying payroll with confidence.

Rate this article

0

over 5.0 based on 0 reviews

Your rating on this news:

Name

*Email

*Write your comment

*Send your comment

1